2010-10-22 17:26:31

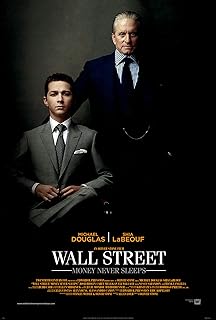

金錢永遠不眠,你洗洗睡吧

************這篇影評可能有雷************

說來慚愧,我沒看過87年的《華爾街》,不過似乎也不影響看第二部。

當戈登拿著磚頭一樣大小的大哥大出獄時,網際網路的泡沫剛剛破滅,接著就是911。格林斯潘的聲譽因為果斷的救市而如日中天。2001 到2007是股市的另一個黃金年代,幾乎買什麼都掙錢。

2008的到來出乎所有人的意料。奧立佛斯通有了一個好題材。

影片的前半部很好,幾乎可以當記錄片看。KZI其實就是映射雷曼兄弟(只是他的CEO沒臥軌。就像戈登後來說的,沒有人會自殺了,那是有責任心的人做的事。),而Bretton 詹姆士 的那家投行就是高盛。第一次聯儲開會在電話上的人叫Paul就是財長保爾森,原高盛的總裁。後來Bretton和Jake在湖邊對話的時候也講到他們公司的原老總就是現在的財長,所以「朝中有人」。連後來聯儲又開會Bretton給的數兒都是後來保爾森最終讓國會給的。印象最深的鏡頭是航拍曼哈頓,一幢幢摩天大廈的玻璃幕帷相互映射,反映了金融市場的虛擬本質。

新世紀的金融市場已經不是80年代的內幕交易可以比得了。如果真的想做個類比,那時的投機最高水平如同練就了九陰真經,現在就像你手裡有把機關槍, 根本不是一個重量級的。結果就是大規模的傷亡。沒有受到影響的,可能就剩朝鮮了。

影片後來的戲是自己編的,可是編得不好。因為這次金融危機里最大的「陰謀」:高盛滅掉雷曼,同時把其他幾家對手也擠得元氣大傷已經路人皆知了。很難再爆出什麼驚人內幕。所以,片子的高潮是在前面,後面只有流於俗套。大團圓的結局,實在是無厘頭, 因為危機遠未結束。可以看得出斯通還是拿著《甘迺迪》的思路拍,要證實陰謀論,但是起碼你也拍成悲劇才對。片子對人性的貪婪以及危機的產生都沒有細究,對政府的救市計劃也沒有反思。他們現在做的和當年格林斯潘做的沒有任何區別,無非是吹一個更大的泡來蓋住正在破滅的那一個。陰謀論的最大問題是,現代社會的關係如此緊密,很難有完全損人利己的結果。即使是高盛對雷曼,也不是高盛搞出個消息就是為了害死它,只能說是雷曼本身馬上要墜入懸崖,高盛沒伸手而已。不過,大多數人就是喜歡通俗易懂,愛憎分明的陰謀論。《貨幣戰爭》這樣不靠譜的書熱賣就是明證。

不過還是得承認,斯通還是下了一番功夫。電視節目的主持人都是真的,給本片前部的寫實性增色不少。而中國作為危機後的最大金主地位,也拿捏得很準確。

但是,如果你認為一個小蘿蔔頭可以搞掉一家大公司,或者危機可以改善家庭關係之類的事,還是儘早洗洗睡吧,這不是你能摻乎的遊戲。

以下是2008年有人要問保爾森關於拯救金融公司的問題,以及保爾森最有可能的回答。

Here are a few questions from a typical man on the street (me) to Treasury Secretary Hank Paulson, and the answers I believe he would give, based on his public positions to date.

Man on the street question: How much did you say you needed?

Paulson answer: $700 Billion

Q: When do you need it?

A: Immediately.

Q: What are you going to do with it?

A: Save the country.

Q: Could you be more specific?

A: Just trust me.

Q: If you don't know what you're going to do with it, how can you know how much you need?

A: I could be off a few billion, but I am very close.

Q: Let's see now, you don't know exactly how much you need, and you don't know what you are going to do with it, but you have to have it right away. Correct?

A: That sums it up nicely.

Q: And what happens if you don't get it?

A: The world as we know it ends. The sky will fall.

Q: Could you be more specific?

A: The credit markets will freeze.

Q: So how will you thaw the credit markets? Just trying to understand.

A: (Impatient) We will buy troubled assets from troubled banks and they will be able to lend again.

After Bailout Approval

Q: Ok. You have the money. Did you buy the troubled assets?

A: Not exactly.

Q: Why not?

A: Well, we could not figure out what they were worth.

Q: Why not?

A: There does not seem to be a market for them.

Q: Aren't banks required to mark them to market value?

A: Yes.

Q: Then why not just pay the value shown on the banks' balance sheets?

A: (Long pause) Er...it seems that some of them have almost no value and of course, no buyers.

Q: Sounds like a good price. Why not pay that?

A: (Exasperated) Because that would not help the banks.

Q: It would get the bad assets off the banks' books. I thought that was the idea.

A: The credit markets are frozen. Besides, we could not figure out which troubled assets to buy.

Q: So what did you do with the money?

A: We're still considering various options.

Q: I thought you had to have it right away or the world would come to an end.

A: We had to have approval to spend it to shore up market confidence.

Q: So how did that work? Has the market stabilized?

A: Wall Street has confidence that we stand ready to invest the money to free up credit markets.

Q: Does the Treasury Secretary, President and Congress shouting that we are heading off a cliff scare the markets?

A: We must free up credit markets to head off another Great Depression.

Q: So have you spent any of the money?

A: Yes, we are taking equity positions in financial institutions. In other cases, we may just give them the money.

Q: So, we taxpayers are investing in failing banks' stock?

A: We are finding various ways to inject capital into troubled banks. We even have a name for our new program. It's called TARP. Troubled Asset Relief Program. That should make everyone feel better.

Q: Relief. Isn't that what they called welfare during the Great Depression?

A: Next question.

Q: So, if the bank fails anyway, won't our stock go to zero?

A: The banks are too big to fail.

Q: Couldn't they undo some of the mergers and acquisitions and foreign investments that made them so big? Maybe that would make them more efficient.

A: These banks are too big to fail. You have no idea of the financial Armageddon that would cause.

Q: After this capital injection, infusion, investment, have the banks started lending?

A: Credit markets remain frozen. Nobody, absolutely nobody, can borrow money.

Q: I borrowed money for a new car just last week.

A: You don't fit the definition of nobody. Nobody means big players.

Q: I have a friend who bought three distressed houses for rent property last week. Financed them all. A real high-roller. Does he qualify as one of the nobodies?

A: If he can borrow money, of course not.

Q: My bank says they are awash in cash and ready to lend it. The president says they are making good loans every day, just like they did before the sky fell. They say profits are good.

A. Your bank is too unsophisticated to understand complicated financial instruments such as collateralized default swaps or the concept of leveraging. It took great brains such as mine when I headed Goldman Sachs to devise such securities. (Head lifting, neck straining). I expect that the president of your bank makes less than a million a year and gets bonuses based on profits or some such antiquated arrangement. He could not possibly understand what it takes to run a real investment bank.

Q: So, how are you going to get the banks to start lending?

A: As I said, we are taking equity positions in the banks. We will make them lend money or know the reason why. We may have to put some members of Congress on their boards. That way, the banks will be run in the same efficient manner that the country is.

Q: Isn't that what caused this mess to begin with?

A: No further questions